How Big is Your Market? 3 Tips to Size it Like a Pro

Assessing market size and potential

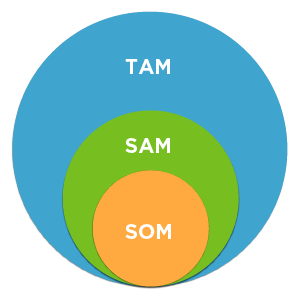

TAM, SAM, SOM define and validate (or not) the market and the entrepreneur’s business plan.

- TAM: Total Available Market – total market demand for a product or service

- SAM: Serviceable Available Market – segment of TAM that you can reach

- SOM: Serviceable Obtainable Market – portion of SAM that you can capture

Investors look for companies that have credibly identified large, reachable market opportunities that are large enough to generate significantly better than average returns.

Investors measure and evaluate business plans in based the size and potential of the market that the startup can capture. That’s why understanding the TAM, SAM, SOM methodology is so important for entrepreneurs.

Follow this checklist to size the market for your startup like a pro.

1. Map expected TAM to SAM to SOM.

- TAM. At the top—the world, the universe, the 100 percent. Even the most optimistic entrepreneur knows that TAM is too broad to capture, that the total number of people on the planet with $2 to spare aren’t all going to buy the newest smartphone app. TAM is the easiest element of a market evaluation to understand and to pare down.

- SAM. A subset of TAM. An honest assessment of the markets the startup plans to serve will take market validation from TAM to SAM. SAM is significantly smaller than TAM. It is the part of the market that a startup can potentially reach. SAM is the segment(s) of the TAM with identified and quantified problems and well-understood pain points. Companies have to budget to pay for solutions. The startup’s technical features must be able to win over the forces of inertia, risk avoidance, and existing and future competitors. Sales and physical distribution infrastructure exist.

- SOM. The share of the market that Seed to Seed+ and Early Stage startups can reach, typically in five (not three) years. These market segments are the targets of the startup’s first 36-month business plan. The features and value proposition of the solution and sales and physical distribution channels align with your SOM.

2. Gather data to determine SAM and SOM

Most startups are not trying to invent a new market. An effective assessment of SAM and SOM will be data-driven, segmented, and credible. Sources will sell you data, but there’s also a lot of information to gain at no charge, just by doing the legwork.

- Search the Internet. Google to find presentations from industry events, proceedings from conferences, and names and websites of keynote speakers. Cull 10K reporting for competitors that are public companies. Cash in on the abundance of surveys and free reports from trade groups. Attend industry or trade association conferences. Read, read, read.

- The competitors are servicing the same market that you are going after. Visit their websites. Subscribe to their marketing and email lists. How does your vision stack up to the reality of the top three players already in the market? What are they selling and through which channels? What are their strategic partnerships? Inertia, status quo, and risk avoidance are competitors, too.

- Measure SAM and SOM not by multiplying an estimated number of people times the price of your solution, but rather through evidence of what potential customers are spending today. You may discover that you’re competing against something that’s “free.” That’s hard pill to swallow, but something you want to know.

- Survey potential customers to find out which features of the solution they will pay real money for. Entrepreneurs are often surprised that features they worked diligently on and assumed were great can get a big yawn from customers.

3. Understand how an investor quantifies an investable market.

Different investors have different views of an investable market or business, depending on whether they are seeking a 10X financial return or a less aggressive financial payback with perhaps more karmic value. However, whatever the goal for financial returns, the evaluation will mathematically calculate based on SAM and SOM.

- SOM projections must be large enough to potentially deliver the return that an investor seeks. A $2MM to $3MM market may be interesting to an entrepreneur, but it won’t be to an angel investor or VC.

- A Concept stage startup with the potential of capturing a 5-10 percent segment of a large SOM could be interesting to many early stage investors. Savvy investors know that it is substantially riskier for a startup to claim 50 percent of a smaller market than 10 percent of a larger one.

- Economic development companies with a mission to gain a return by growing regional opportunities consider investing in companies serving smaller SOMs if that market offers reasonable growth and enables regional expansion, creates local jobs, and leverages regional infrastructure.

This TAM, SAM, and SOM discussion is an element of a larger mosaic of market validation. Validating the market in this way is the lynchpin of any successful business plan. Use our tool to help identify your market.