How to Solve the Puzzle of New Product Pricing

“Rule No. 1 is never to lose money. Rule No. 2 is never forget Rule No. 1.”

Whether or not Warren Buffet, the Oracle of Omaha, actually authored this oft-quote line, his “rules” are an excellent starting point for any pricing strategy discussion. Setting the price for a product is one of the most critical decisions a company can make.

“Predicting rain doesn’t count. Building the ark does.”

Product price can be the most powerful lever of entity value growth or value destruction.

The formula for profit (price x volume – costs) looks simple; achieving the desired result, not so much. Product pricing is much more complicated and nuanced in practice than in economic charts and graphs.

Any variable—internal or external—that affects the business also has an impact on price. Some are predictable or in the company’s control. Many are not. These variables include:

- Product configuration and bundling

- Maintaining or developing the status of the brand

- Costs to produce and sell products

- Regulation and legislation

- Supply chain disruption

- Industry pricing practices

- Competition – lower barriers to entry, increased price transparency, price wars

Align your new product pricing strategy with the business strategy.

- Maximization: If maximizing revenue is goal number one, the corresponding pricing strategy is to price the product as high as possible for each sale. Startups use this strategy when there is no apparent customer willingness to pay higher prices for a differentiated product.

- Penetration: If leadership prioritizes market share, the pricing strategy would be to set a lower price to enter a competitive market with plans to raise the price later. This strategy is a “land and expand” approach. The intention is to minimize adoption friction and then increase price with a more differentiated product.

- Skimming: When the company prioritizes profit margin, a “skimming” profit strategy sets a high price initially and lowers it as the market evolves. Think Apple. The idea is to start with a high-end product, then systematically expand the customer base with more and less expensive products.

“Price is what you pay. Value is what you get.”

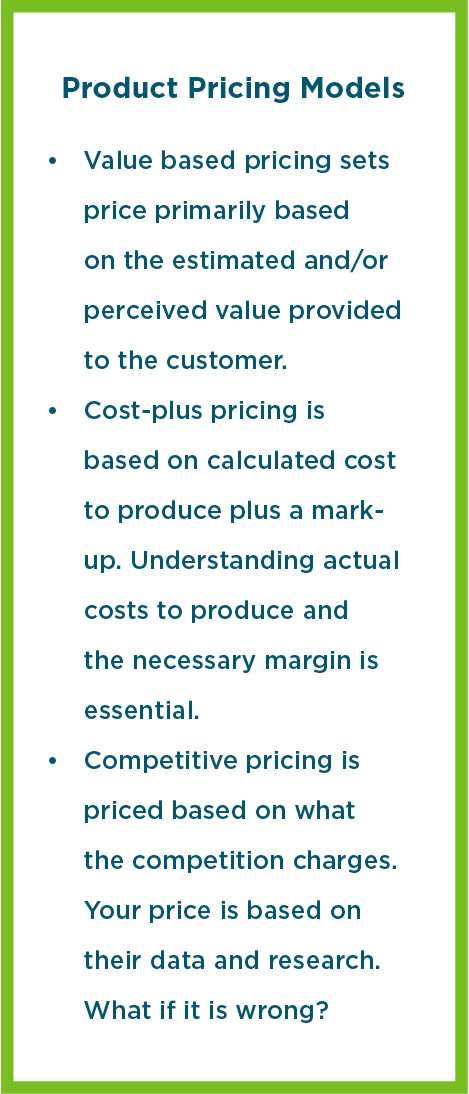

The three most common approaches to pricing are value-based pricing, cost-plus pricing, and competitive pricing. For high-growth, advanced technology startups, our focus is on value-based pricing.

Value-based pricing is an outward-facing strategy, appropriate when the product’s value is significantly greater than existing alternatives. Customers show a strong inclination to be willing to pay for these differences.

Value pricing is based on understanding and quantifying the economic and perceived value to the customer. The construction begins with detailed customer segmentation by product and price.

Identify which segments value the real and perceived economic benefits of which features. Various market segments may define and calculate economic benefits differently. Economic advantages may be defined as specific cost savings—a measurable budget reduction or reallocation. For others, economic benefits may be expressed in human efficiency. Still, others may identify perceived opportunities for increases in revenue or market share from sales, new business lines, or expanding marking agreements. The goal is a pricing strategy that provides segments with differentiated offerings and pricing to optimize customers that are willing and able to pay.

Segment groups by customers who are willing to pay for higher levels of functionality that are not made available to all customers. Additionally, identify groups of customers who would buy the product if the price were lower. Develop strategies to differentiate your products to appeal to the segments willing to pay more. For example, packaging, combining features, or additional levels of service can tap into segments willing to pay more.

A business will not exist if it does not eventually generate cash flow from profits from the sale of its product or services. To be successful, a company must develop a revenue model that monetizes the value they are creating, matching how customers want to pay. They are many types of models. Here are five revenue models along with industry examples of each.

- Subscription – The Wall Street Journal, Netflix

- Dynamic – OSU football tickets (Tulane $67 and Michigan $195), Southwest Airlines, Uber

- Auction (market-based) – eBay, Auction Ohio, Google AdWords

- Pay-as-you-go – GE Financial – Expensive machinery – MRI machines

- Licensing model – Disney, Universities, US government, biotechnology companies

“The most important thing to do if you find yourself in a hole is to stop digging.”

Any pricing strategy has danger zones, so a few words of caution are in order.

- Most of us have the instinct to please customers. Suffocate any instinct to give away value-added features, and only add features that customers are willing to pay for your product development plans.

- Just because customers say they are willing to pay for something doesn’t mean they will. Make cost justification and revalidation of benefits an ongoing part of your business development and sales process.

- Value-based pricing is built on data, not intuition. Your pricing strategy requires constant data collection and analysis. Pricing should never be a one and done scenario.

- Be prepared to pivot away from product features or customer segments if they turn unfavorable. You can’t price products below cost and make it up on volume.

“When it rains gold, put out the bucket, not the thimble.”

A great side benefit of value-based pricing is that when you depend on your customers as a key participant in your price-setting strategies, you have to talk with them a lot. While the company builds a stable pricing model based on studying their economic and perceived value in your products and solutions, you are also building trust and a strong relationship with customers.

Learn more about how Rev1 helps startups develop pricing strategies. Connect with us here.

Quotes attributed to Warren Buffet.