The Brightest Companies + The Biggest Impact

Rev1 has invested in more than 130 companies, positioning Columbus as the Midwest’s hub for startup growth. With more than $130MM in capital under management, Rev1 invests from pre-seed through early-stage.

Why the Midwest?

Here startups are working alongside leaders across diverse industries to bring strong solutions to market.

Stronger From the Start

Our portfolio leverages our investor startup studio, giving startup companies a stronger foundation. Clients have access to corporate connections, top talent, mentor network, innovation space, and a continuum of capital.

“Experience, transferable advice, and process-driven due diligence helped with customer confidence, and helped convince new investors to participate in our last round.”

SHARE Founder, Hoa Pyles-McManus

Co-investment

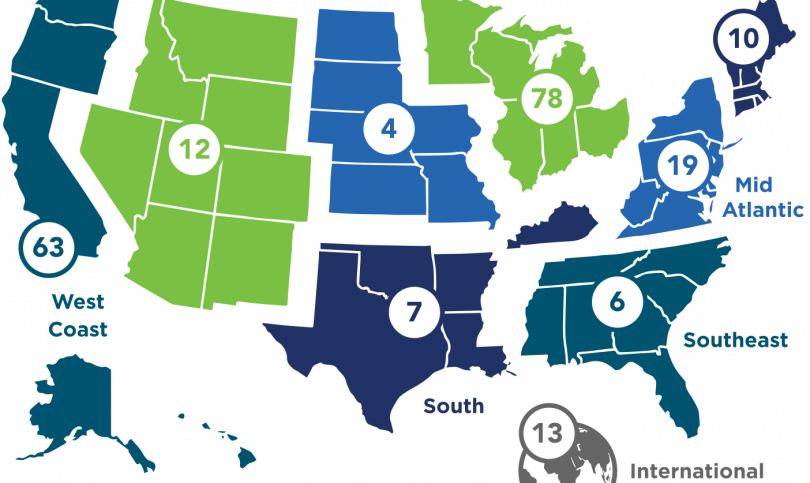

Our companies have attracted co-investment from 26 states and 8 countries.

We’re known for two big things.

Enterprise Software and Life Sciences

These two industries stand out in our region: Enterprise software because of the application to the large, diverse Fortune 1000 base, and life sciences because our world-class research institutions are spinning out scientific breakthroughs. We also see hundreds of startups in alternative energy, advanced materials, and food & agtech.

See Our PortfolioPortfolio Traction

Rev1 is among the most active seed investors in the U.S., according to PitchBook.

Aware provides the solutions you need to address compliance, data governance and human behavior risk within enterprise collaboration networks.

Learn more about Aware

BeeHex is a robotics company modernizing food preparation and personalization with the 3D printing system of the future.

Learn more about BeeHex

SaaS-based precision medicine software suite focused on the lifecycle of the biospecimen from specimen capture through diagnosis.

Learn more about Deep Lens

Improve the customer experience and reduce inefficiency with automation powered by Artificial Intelligence.

Learn more about Flyreel

Connects student-athletes, parents, and coaches with a certified athletic trainer via a telemedicine video app for triage through recovery.

Learn more about Healthy Roster

An all-in-one reality capture system that produces stunning 3D walkthroughs, virtual reality experiences, video, technical assets, and more.

Learn more about Matterport

MentorcliQ drives employee engagement, development, and retention through an award-winning mentoring approach and technology.

Learn more about MentorcliQ